1Created in 1982 by a group of Haitian healthcare professionals, GHESKIO is one of the oldest organisations working on research and treatment for HIV. Housed in the south of Port-au-Prince, close to one of the city’s poorest areas, it was granted the status of an independent non-governmental organisation in 1987 and designated “Public Utility” by the Government of Haiti in 2000. As the Main centre for research, training and treatment of patients with HIV/AIDS in Haiti, GHESKIO is now a national reference centre for HIV/AIDS, tuberculosis (TB), sexually transmitted infections and diarrhoeal diseases.

2Over 150 000 people in all age groups are seen by GHESKIO every year. Among them 24 000 are followed for HIV infection, including 4000 who receive antiretroviral medication. Around 600 people are diagnosed with TB and receive treatment every year. GHESKIO’s healthcare programme addresses the most deprived sectors of the population who are most exposed to HIV. The care is provided free of charge and is mainly funded by the United States President’s Emergency Plan for AIDS Relief (PEPFAR) and the Global Fund to Fight AIDS, Tuberculosis and Malaria (Global Fund).

3ACME is a non-profit organisation founded in 1997, specialising in urban micro-financing. Its mission is to help micro-entrepreneurs, who do not have access to bank loans, to develop their business activity. It provides an expeditious solution to the financing needs of the greatest possible number of medium and small players in the informal sector, in every branch of the economy.

4ACME has a central office and a network of 12 agencies operating throughout the metropolitan area of Port-au-Prince. As of end 2007, it had a portfolio of 20 169 clients, 69% of which were women, representing a portfolio value of 23.2 million dollars.

5ACME is a founder member of the “Association Nationale des Institutions de Microfinance d’Haïti”, which is a group of 17 Haitian micro-finance institutions and includes associations, foundations, banks, private sector companies and NGOs.

6ACME has been cooperating with the Consultative Group to Assist the Poor (CGAP). It has received the support of various development institutions, including USAID and the Inter-American Development Bank.

7Fondation Mérieux was created in 1967 by Dr. Charles Mérieux, in honour of his father Marcel Mérieux who studied with Louis Pasteur and founded the Institut Mérieux in 1897. This independent, family-held foundation combating infectious diseases was officially designated “Public Utility” in 1976.

8The Foundation runs the Pensières conference centre in Veyrier-du-Lac where it disseminates scientific and training expertise in the field of public health. Under the leadership of Christophe and Alain Mérieux, it is also committed to capacity-building for the people involved in fighting infectious diseases in developing countries.

9With a population of 8.9 million, Haïti is the poorest country on the American continent. The United Nations Development Programme (UNDP) notes that 65% of its population lives below the poverty line (UNDP, Human Development Report, 2007/2008). Forty-three per cent of the adult population is illiterate. Access to safe drinking water is difficult for 46% of the population and 5.5 million people live without electricity. The workforce represents 3.6 million individuals, most of them unskilled. Over 2/3 of them work in the informal sector, mainly subsistence farming. The high level of illegal emigration for economic reasons to the Dominican Republic, other islands in the Caribbean and large cities on the North American continent is indicative of the hardship faced by Haitians in coping with everyday survival (UNDP, Human Development Report, 2007/2008).

10The World Health Organization (WHO) estimates the life expectancy at birth in Haiti at 56 years for women and 53 years for men. Infant mortality for the under-fives is 117 for 1000 live births and maternal mortality is 680 per 100 000 births (WHO, Mortality Country Fact Sheet, 2006).

11Haïti is the country in the Caribbean which has the highest HIV prevalence: 2.2% of adults carry the virus. For 2007, the number of people living with HIV/AIDS is estimated at 109 116 for adults and 5888 for children. Feminisation of the epidemic is increasing: in 2006, the ratio was estimated at 115 women to 100 men. The latest Mortality, Morbidity and Utilization of Services Survey (EMMUS-IV, 2005–2006) does, however, indicate that the HIV epidemic has reached a point of stabilisation in Haiti (UNAIDS, National Report on Monitoring Progress Towards the UNGASS Declaration of Commitment on HIV/AIDS, Haiti, 2007–January 2008).

12At the end of 2002, Haïti received US$84 m from the first round of the Global Fund (The Global Fund to fight AIDS, tuberculosis and malaria, Progress Reports, Haiti). An additional US$21 m was granted by PEPFAR in May 2004 (PEPFAR, The President’s Emergency Plan for AIDS Relief, Haiti).

13Thanks to this international support and to the expertise in the field of HIV/AIDS therapy on the part of GHESKIO, working in the west of the country, and of “Zanmi Lasante” (Partners in Health) in the centre, people living with HIV have access to antiretroviral therapy free of charge. At the end of 2007, Haiti had 125 VCT sites for HIV, 91 sites for PMTCT, 123 sites for palliative care and 48 sites for antiretroviral therapy distributed over the ten Haitian health districts. In October 2008, 17 716 people were treated with antiretroviral drugs.

14In 2003, Alain Mérieux travelled to Haiti to honour the memory of his son Rodolphe who had worked in this country with the French Co-operation. During this visit, he met with Raymond Sinior, Director of ACME, to discuss the initiation of a microcredit project. He also met with Dr. Jean William Pape, Director of GHESKIO, and offered to send a biologist to assist with improving the laboratory facilities in the centre for healthcare to people living with HIV/AIDS. For two years, Emilio Brignoli actively participated in the reinforcement of GHESKIO’s biology laboratory and in the training of lab professionals.

15At the same time, Global Fund support for the Haitian HIV/AIDS control programme improved its access to antiretroviral therapy.

16In parallel, following the consideration by Dr. Pape and Dr. Deschamps of how a more comprehensive management strategy for people living with HIV/AIDS could be achieved, GHESKIO implemented a food-aid project for pregnant women with the support of the United Nations Population Fund (UNFPA). This food-aid project improved the quality of life of the women concerned and enhanced their adherence to treatment (GHESKIO and UNFPA, unpublished).

17At this point, the idea of a joint project bringing together GHESKIO, ACME and Fondation Mérieux was born, with the object of extending the support given to women receiving food aid. At the end of 2004, at a meeting involving Raymond Sinior, Marie Marcelle Deschamps, Deputy Director of GHESKIO, Emilio Brignoli, Jean Louis Machuron, consultant from Fondation M´erieux, and Alain M´erieux, a microcredit pilot project was launched to help women living with HIV under GHESKIO care.

18More women living with HIV in precarious economic circumstances have been enrolled by doctors, primarily among the beneficiaries of the food-aid programme, than among the other patients. The GHESKIO voluntary counselling and testing centre was able to extend the programme to newly diagnosed HIV infected women and soon to HIV-negative but particularly vulnerable women.

19The doctors refer the patients, whose physical and mental capacities are compatible with the running of a business enterprise, to the GHESKIO social workers. The social workers make sure that there are no debts which would compromise repayment of the loan. Initially, they asked the women to appoint a tutor, who could be a member of their own family or a friend, whose task was to assist in complying with antiretroviral therapy, to provide assistance if required with commercial activities and to step in should reimbursement of the loan became an impossibility. But it was soon clear that this tutorship prerequisite was more of a hindrance to participation in the programme than a factor for success. In fact, candidates to the microcredits usually state that they do not have any person close to them with whom they would like to share confidential information. As it turned out, the debt reimbursement levels were satisfactory and it was possible to eliminate this condition for inclusion in the programme.

20Those meeting the preliminary criteria are referred to ACME who regularly organise a training course for groups of some twenty candidates. The two-day course aims to teach basic business management principles and to explain the commitments ensuing from the microcredit procedure. At the end of the course, a one-to-one meeting is arranged to prepare the microcredit application file. At this point, some participants decide not to take out a loan (1–3 per training session).

Figure 1. Access to a “GHESKIO loan” remains entirely confidential following ACME’s normal procedures.

21Once the credit is approved, a single disbursement is made, to be paid back in four to ten monthly instalments with a one month grace period to allow time to launch the commercial activity.

22The first loan totals 1500 to 25 000 gourdes (30–500 €) depending on how the client’s management capacities are assessed and how much trade experience she happens to have. Further loans may be doubled.

23A specific financial product was created by ACME for these vulnerable women. Interest rates are set at 2% per month whereas it would be in the area of 3.5% for other clients. These loan applications are processed in exactly the same way as a request from another source. With regards to confidentiality, the words “GHESKIO loan” in the file is sufficient to gain access to a training session and the offer of a preferential rate, but the individual’s HIV serostatus is not disclosed (Fig. 1).

24GHESKIO provides the beneficiaries of the microcredit programme with continuing healthcare, while ACME supervises the progress of the loans and business activities, which usually belong to the informal sector: sale of new or second-hand garments (“pepe”), shoes, cosmetics, domestic implements, coal, fast food (“fritay”), etc. (Fig. 2).

25Fondation Mérieux, with financial support from Fondation Christophe et Rodolphe Mérieux, underwrites the non-repayment risk based on a 40 000 € loan security fund managed by ACME. It also shoulders the cost of training courses, i.e. approximately 1500 € for each two-day course including the services of two monitors to train about twenty women and serving them a midday meal. The activities of the ACME loans officers and the GHESKIO social workers attached to the programme are also paid for by Fondation Mérieux.

Figure 2. Street scene – most of Haiti’s economic activity is in the informal sector.

26Since the programme began, in March 2005, up to June 2008, 1061 women have benefited from 1538 loans for a total amount of 11 373 000 gourdes, i.e. some 216 000 €. Two hundred forty seven women were granted several loans (up to seven loans, to date).

27The cost to Fondation M´erieux, over the same period, was in the region of 100 000 €, excluding the loan security fund, for training and staffing costs to implement the programme.

28The period from March 2005 to December 2007 was the subject of a study (Deschamps et al., 2008). It covered 420 women, of which 240 (57%) were living with HIV including 113 women receiving antiretroviral therapy. The sociodemographic profile of the women is shown in Table 1.

Table 1. Sociodemographic profile of the first 420 beneficiaries of the microcredit programme, according to HIV serostatus

(Deschamps et al., 2008).

29Although the women’s level of education was very low and their economic circumstances particularly difficult, their loan repayment record was excellent, in the area of 94% and identical for both HIV negative women (95%) and those living with HIV infection (93%). Among the latter, repayment records were equivalent regardless of whether they were, or were not, receiving antiretroviral therapy.

30In May 2006, a survey provided a preliminary evaluation of the impact of microcredits on the quality of life of women infected or affected by HIV/AIDS (Covello et al., 2006). Among the first 77 women to benefit from the programme, 66 women – including 61 living with HIV – were interviewed 6 to 12 months after having received a loan. Eleven women could not be heard because of various difficulties and setbacks, such as moving house, residence in a dangerous area, no-show at the interview, etc. A control group of 30 women who had not received a loan, out of which 27 were HIV positive, all enrolled in GHESKIO, with the same initial socioeconomic and medical status, as estimated from their file, responded to the same questionnaire.

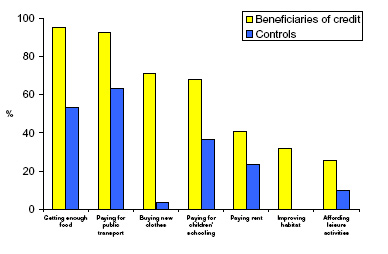

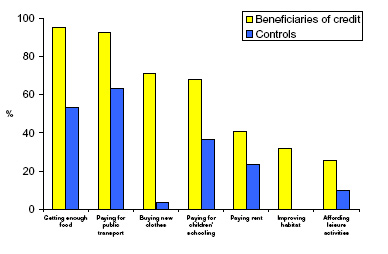

31The questionnaire assessed the perception of the women of their own capacity to cope with their daily life and their self-reported annual income. The survey revealed significant differences in living conditions between the women who were the beneficiaries of loans and those who were not, as measured by their perceived capacity to feed, clothe and house themselves (Fig. 3). Among the 66 women in the beneficiaries group, 33 (50%) reported an annual income of over 6,000 gourdes (approximately 120 €). In the control group, only one woman (3.3%) attained that level of income (p<0.001).

Figure 3. Impact of microcredit on the living conditions of the first 66 beneficiaries of the programme – Perceived capacity to cope with certain day-to-day requirements

(Covello et al., 2006).

32Differences in self-assessment of the living conditions between the two groups of women are very significant for each of the dimensions under study (p<0.01) except for paying rent (p=0.09) and affording leisure activities (p=0.07).

33With regards to the psychological impact of the programme, 38/66 (58%) of the women who were beneficiaries of the microcredit said they were happy. In the control group, the figure was 12/30 (40%) (Non-significant difference, p=0.1). In both groups, despite antiretroviral therapy, many women still worried about their health and their future and hoped for a “real cure” for HIV infection.

34Adherence to antiretroviral treatment, measured by whether pills had been taken in the three days preceding the interview, was greater than 92% and similar in both groups (22/23 and 12/13).

35The CD4+ lymphocyte count curve, as observed in the medical records, was judged to be similar in both groups, i.e. stable for most women, but the mean values were not measured.

36To the question: “Do you ask for money in return for sex?”, 4/66 (6%) of the beneficiaries of microcredits answered in the affirmative, versus 5/30 (16%) in the control group. This difference, however, does not attain the significance threshold (p=0.1).

37The programme for access to microcredit for women living with HIV or vulnerable to the virus in Haiti, was born from the encounter and common endeavour of the people running three private organisations working for public utility. The main factors, for the success of this project, are the professional quality of the work carried out by these organisations and the commitment of their leaders to serve humanity. The GHESKIO and ACME officials work in a particularly difficult environment but they never cease to improve the living conditions of their fellow Haitians. With the support of Fondation M´erieux, they have combined their efforts to ensure the success of a programme in which the battle against poverty and the battle against HIV are fought jointly so that the vicious circle, described by the experts of UNAIDS and The World Bank, in which poverty leads to HIV infection and infection induces poverty (Adeyi et al., 2001), can be broken (Fig. 4).

38Inadequate income can be the reason why people accept payment for sexual favours which lead to increased risk of exposure to HIV infection. This is the case for 16% of Haitian women not benefiting from microcredits who are enrolled in the GHESKIO programme and who were interviewed by Covello in 2006. For the women who are beneficiaries, the figure is reduced to 6%, although the significance threshold is not attained. A survey in the neighbouring Dominican Republic at the same time suggests that women’s control over their own income is significantly related to a greater capacity to negotiate safe sexual practices, but that the fact of having received a loan is not significantly related to such power of negotiation (Ashburn et al., 2008).

Figure 4. Relationship between poverty and HIV/AIDS: a simplified view by UNAIDS and The World Bank

(Adeyi et al., 2001).

39Together with access to education, means of prevention and antiretroviral medication, reducing poverty is, without a doubt, one of the major strategies to use against the HIV pandemic.

40The theory that improving a person’s financial status, by access to microcredit, reduces the risk of being infected by or transmitting HIV infection would deserve to be studied prospectively with a larger sample and a more in-depth analysis of behaviours and practices, such as the use of condoms.

41Some microfinancing institutions include sessions for HIV education and prevention in their microcredit programmes. But only rarely do they develop specific products for people living with HIV/AIDS (PLWHAs) so as to mitigate the socioeconomic impact of the infection (Ettedgui, 2008). ESTHER “Ensemble pour une Solidarité Thérapeutique Hospitalière en Réseau” (Network for therapeutic solidarity in hospitals), has set up partnerships in some African countries such as Senegal, Benin, Burundi and Mali, with NGOs and microfinancing institutions in order to promote access to income-generating activities for PLWHAs (ESTHER, Progress Report, 2007). The projects supported are either individual or collective. The evaluation of such programmes provides evidence of varying levels of repayment depending on the partner associations. The improvement of care and living conditions for PLWHA beneficiaries do seem to be a consequence of such action, but more in-depth evaluation is needed to quantify these results. AIDES, a French non-profit association to combat AIDS, and PlaNet Finance have also created a programme to support the development of income-generating activities for PLWHAs in Burkina Faso. No evaluation has yet been published. Handicap International, which has long-established experience in microfinancing for the economic insertion of the disabled, includes PLWHAs in some of its programmes, but has not published anything on the subject. Other projects exist, supported by the Society of Women against AIDS (SWAA) in various African countries, by UNDP in the Shanxi province of China (UNDP, China Community Based Care, Support and Poverty Reduction in Shanxi), and Socios En Salud in Peru (Zeladita et al., 2008). In the absence of any publication regarding the impact of such programmes, it is impossible at this point to model the most pertinent and effective approaches.

42The Haitian programme run by GHESKIO and ACME is, to the best of our knowledge, one of the most significant programmes giving preferential access to microcredit for women living with HIV. With over three years follow-up, it is proof of the feasibility of this approach when it is the fruit of cooperation between professionals in healthcare and their counterparts in microfinancing. The women benefiting from this programme report better living conditions. This remains to be confirmed in a study where the baseline characteristics of the case and the control groups are better captured and undoubtedly similar.

43The current challenges facing the programme are extension and sustainability which implies upscaling from social microfinance to break-even situations. The excellent repayment record now prevailing is an encouragement to start thinking in terms of a self-financing project, which means that it would be necessary to increase interest rates, at least for subsequent loans, and reduce the cost of training beneficiaries and supervising the progression of the loan. According to Luc Rigouzzo, Head, Financial and Private Sector Development, AFD, “What is important to the poor is not the cost of credit but instead a lasting access to credit” (Rigouzzo et al., 2005). What would be the impact on access to loans and on the repayment level of an increase in interest rates? What kind of minimal initial training would be sufficient to enable an income-generating activity to be successful? These are the important questions to which GHESKIO, ACME and Fondation Mérieux must find an answer to ensure that the programme develops and endures, while retaining the capacity to allow vulnerable people to have access to it and benefit from it.

44Combined with antiretroviral therapy, microfinance is certainly one of the most valuable instruments to reduce the impact of HIV on infected people in countries with limited resources.

45“We must give hope to those infected with HIV, enabling them to plan for life instead of preparing for death ...” was the message from the Secretary General of the United Nations, Kofi Annan, in May 2001. This is also what GHESKIO, ACME and Fondation M´erieux are seeking to achieve with the microcredit programme for women living with, or vulnerable to, HIV in Haiti. Looking back over three years of experience, it can be stated that this microfinancing programme is working well and that it has improved the lives of beneficiaries. Future challenges to this Haitian programme are its extension and sustainability which require moving on to viable, self-financing microfinance, without losing sight of its mission of providing support to vulnerable people. It would be worthwhile to compare this programme with others, in particular those which involve community organisations. Sharing lessons learnt, successes and challenges would allow identifying the most effective approaches.